Mortgages on Blockchain- a working Proto-type using Hyperledger Fabric

Mortgages on Blockchain- a working Proto-type using Hyperledger Fabric

Background

Mortgage industry has been around for a long time but has not improved its end to end mortgage application processing times. This is due to the archaic technology and processes still followed by the parties involved in the mortgage food-chain. Currently it takes on an average of 40+ days from submitting home loan application to closing the loan and settlement of funds.

Blockchain mortgages has a potential to disrupt the existing processes and could eliminate costs and inefficiencies thus improving funding time and saving a lot of fees that are currently charged in each step of application processing.

This article is an attempt to demonstrate sample blockchain implementation for mortgages.The source code and relevant assets are available at MortgageBlockchainFabric-GitHub.

Status-quo of Mortgage Processing

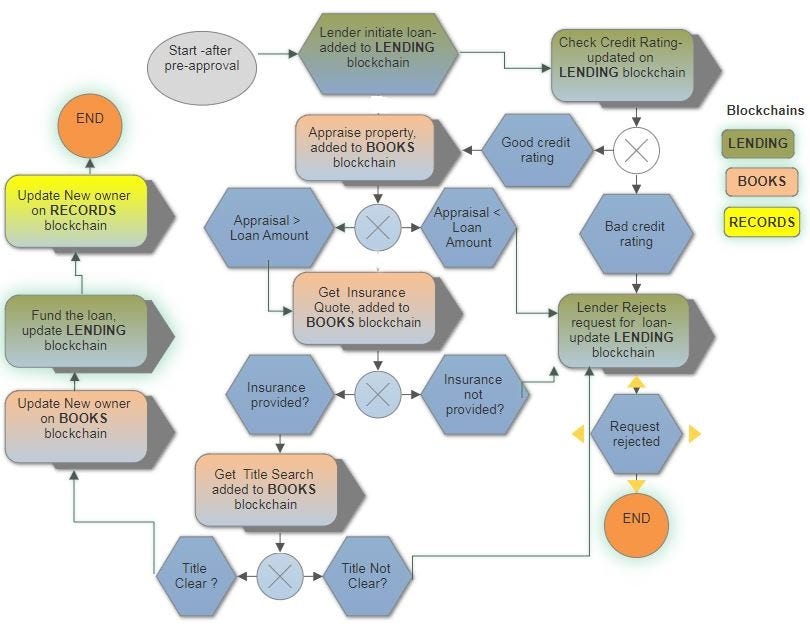

Traditionally there are seven actors/parties involved in the processing of loan application that consumers have to deal with; they are depicted in the figure below. The journey a mortgage application endures during different stages adds to delays culminating in the final ownership by a consumer after 40 days- hopefully if everything goes well!

Blockchain mortgages to the rescue:

Blockchain is a distributed ledger that is encrypted/secured so that it is only accessible to members of the parties that are authorized to access it. Currently, various parties listed in the figure maintain their own records which are either private or public. Lenders, insurers, credit bureaus need to access/provide necessary info needed to decide creditworthiness of borrower or feasibility of the loan amount based on valuation of the property. At the same time respective records need to be updated when the information is exchanged or a transaction is carried out by each party. All these tasks are currently handled manually.

With blockchain mortgages, the information or data required to assess and approve a loan application would be securely stored on a network where these ledgers would be updated automatically and in real-time. The use of this distributed ledger technology (DLT) technology would allow loan contract to be generated automatically, set up home loan account, transfer and register ownership of the property.

Blockchain Mortgage Processing with Hyperledger Fabric

Internet is littered with articles and suggestions on how blockchain is going to revolutionize mortgage industry. You can find reports at Nasdaq, Pwc, & American Banker to name a few. There has been progress made in AU (ANZ, Westpac banks and a few startups) and UK FCA regions towards moving mortgages on blockchain. Platform integrators for e.g. Synechron can help lenders implement blockchain. However, there are not many technical details around a practical implementation for blockchain mortgages.

We will be looking at permission/managed/private blockchain where mortgage actors are required to get consent from membership authorities to join the blockchain network. Hyperledger Fabric is a permissioned blockchain platform contributed by IBM and provides plug-and-play modular blockchain components. You can see find more information about it in my previous post here.

Setup

We will model three blockchains or channels as they are called in Fabric. A channel includes only the transactions made in that channel. Channels also play an important role in ensuring privacy by restricting read access to authorized signatories. And, channels provide a means to control deployment of chain code. A channel is a logical grouping of selected peers in the blockchain network. It allows peers associated with that channel to see each other’s transactions, but peers outside the channel cannot see these transactions. It provides a level of transaction privacy and security among the peers. Each channel could have same or different smart contract instantiated, based on business needs. At the protocol level, chaincode is the compiled form of smart contracts that runs on Hyperledger Fabric networks. The most supported high-level language is Go, which is used in this illustration.

A mortgage consortium is created with all the actors and has the following components:

- A peer for each organization

- Pre-created Member Service Providers (MSP) for authentication and identification

- An Orderer using SOLO

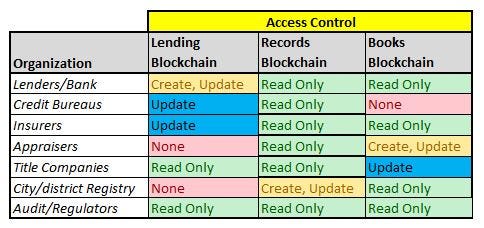

- Three Channels/blockchains:

- Records blockchain — is a public blockchain which is owned by City/District for recording properties, details, ownership and title history for tax purposes. Everyone has read access to it but only Registry (City) can create and update it.

- Lending blockchain — is for lenders, credit bureaus, Title companies, and Insurers to share information about prospective buyer. It is off limits to others for protecting sensitive information and data integrity. Lenders can create/originate loans, Bureaus, Title companies and Insurers can update them, and auditors/regulators have read only access to it.

- Books or Appraiser-Title blockchain is for appraisers and title companies to add/update transactions. Since these are third parties to lenders, and to resolve conflict of interests with lenders, lenders have read only access- which it needs for processing loan.

Benefits to Consumers

- Sizable reduction in upfront mortgage processing fees and ongoing overheads.

- Streamlined sharing of information through “smart” contracts allowing multiple parties to communicate and share information with each other in real-time.

- Appraisals performed for properties can be made public and potentially reused during valid timeframes, so new appraisals can be avoided- not so good for third party appraisers!!

- Significantly speed up application and settlement process which could reduce the time from application to settlement from 40+ days to about 5–10 days- a huge improvement.

- Opens up peer-to-peer (P2P) lending with investors on the blockchain network, creating competition for the banks and setting a price war where customers will reap the savings.

- Provenance- a feature of blockchain can provide accuracy in record-keeping through data sharing, which means there’ll be an indisputable paper trail to rely on to detect fraud and eliminate human errors, regulators will have access to all the transactions in real-time.

- Better fraud detection leads to more confidence for regulators in mortgage industry- and help alleviate bad experiences of MBS/CDO melt down in 2008–2010 financial crisis. This will relax requirements from lenders to hold capital reserves and use them for better lending practices.. .

A win-win for lenders to use their capital optimally and consumers to get better loan rates.

Github & Demo

Please download/clone the repo from github . The repository has all the modules and sources to install components. Readme.md provides detailed instructions to setup and run the application.

References

Hyper ledger Project, Hype ledger Fabric, B9Lab, IBM Hyper Ledger Developerworks, HomeLoanExperts

*Images used are available publicly on the Internet.